EUR/USD

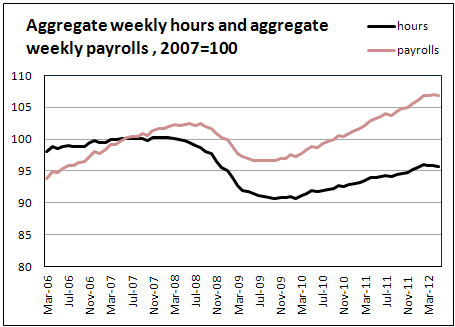

In one of our reviews last week we said that the markets could grow till the beginning of autumn. Yet now there is a feeling that autumn is right on the threshold. The optimism of stock market players, which has been growing after the recent release of fomc's minutes, reached its zenith yesterday. It's surprising that the markets supposed to deal with a chain of favourable economic reports and didn't take into account that the Fed could revise its plans for easing the policy in September. Beige Book published yesterday once again proved that things are getting better in the USA. Activity has increased since the previous review. Besides, almost immediately after FOMC's last meeting (August 1) we saw positive reports on the labour market and industrial production. By the way, let's dwell a bit on the connection between industrial production and inflation. The most recent report of the Fed (these statistics are published right by this institution) indicated the increase in the capacity utilization up to 79.3. Earlier under such circumstances Bernanke's predecessor, Alan Greenspan, began to gradually toughen the policy. But as you remember, Greenspan was criticized for keeping rates low for too long. The thing is that the high capacity utilization provokes acceleration of inflation. The corporations have already reached the point when they are no longer able to delay spending. Sitting on the sacks with money, acquired at incredibly low interest rates, American corporation should finally venture investments into durable goods. It doesn't guarantee an immediate effect on employment, but for sure will prevent prices of a wide range of goods from falling. Besides, now the inflation expectations are not as low as they were by the time of the launch of the previous asset purchase programmes. In short, it is too early for QE now. It would be more reasonable now to cool risk demand, make inflation expectations lower and cut oil and food prices. There's no sense in worrying about stock exchanges and confidence in the dollar. The latter, in fact, is warmed up by the European crisis.

GBP/USD

The British pound closed out Wednesday above 1.58, thus exceeding the daily high of Tuesday. Yet the sterling cannot go higher as bears, which were selling the pair from the level of 1.5850, are standing in the way. Today the struggle is very likely to continue and promises to be even fiercer. Our moderately pessimistic view on the further demand for risky assets urges us to stake on the victory of bears. Earlier we considered that the markets had the potential to go higher, however the time is up and the further growth will be a problem. The only thing that can save the pound is the weaker performance of other currencies, due to which the pound will be able to feel a bit better in the crosses (look closely at the crosses with commodity currencies).

The slightly positive tone of Beige Book, which reduces chances of QE in September, has somewhat deprived the stock market of its optimism. The only thing, which can be favoured now, is positive economic reports. However, the annual growth rate of 15% in the index of pending home sales is unable to keep the markets in the green, which was clearly seen yesterday.

AUD/USD

The aussie reached the level of its 200-day MA at 1.0335. Our target of correction is achieved. Now we should step aside and watch how trading will develop around this mark. In case the attack of the resistance is a success and the level of 1.03 is broken, it will be a sure sign of bears' capitulation.