Eightcap Cashback Rates

If the trading account that you want to assign to our partner group was opened earlier, you need to send a request to the broker. A sample letter is shown on the right. The transfer of an account to a partner group occurs at the sole decision of Eightcap.

Once your trading account has been transferred to our partner group, please send us an email notification support@globegain.com. This is necessary to speed up the approval of the invoice in our system.

Dear Sirs,

Please place my account xxxxxxxxxxx under IB 35371.

Kind regards,

John Brown

Eightcap Review

Eightcap was founded in 2009 in Melbourne, Australia. The company operates in five offices across the world and provides CFD services across a range of markets, including Forex, Indices, Commodities and Stocks. More recently, the Australian-based broker added 50 of the largest U.S. stocks to its offering.

Eightcap offers two account types that aim to meet its users’ trading needs and goals: the Standard Account and the Raw Account. The Standard Account offers spreads from 1.0 pips with zero commission applied, and the Raw Account offers spreads from 0.0 pips with a commission of $3.50 per lot (one-way).

Both account types require a minimum deposit of A$100, with a minimum trade size of 0.01 standard contract, and offer a maximum leverage of 1:30 for Australian clients and 1:500 for non-Australian clients. Leverage is also asset dependent.

Eightcap Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) (AFSL no. 391441), and accepted clients outside Australia fall under Eightcap Global Ltd, regulated by the Vanuatu Financial Services Commission (VFSC) (Financial Dealers Licence no. 40377).

Building a home for both MT4 and MT5 traders, by providing an exceptional financial service to clients, is the mission and core value of Eightcap’s business. Eightcap consists of highly professional experts in the financial industry. The broker’s focus is to understand the needs of traders and partners, and create tailor-made solutions to help them unleash their trading potential. Eightcap caters to both retail and wholesale clients. To provide the best trading experience, Eightcap offers professional trading terms in a wide product range, such as low latency connectivity and premium pricing.

Eightcap holds client funds in segregated accounts within Tier-1 banks, so their clients can trade within a safe environment. Providing the simple and transparent structure of the products, Eightcap creates an authentic trading environment. For example, the broker offers strong educational resources to its users. Eightcap clients receive regular market updates, a weekly trading week ahead and technical and fundamental guides. Eightcap has also recently formed a strategic partnership with Capitalise.ai, allowing its clients to automate their trades code-free, with no experience needed.

In addition, trading with Eightcap will build trading confidence and satisfaction, due to the intuitive easy-to-use trading platforms and individual approach of the sales team. Eightcap is an award-winning broker* - focused on the security and peace of mind of their clients.

Eightcap - The Home for MT4 Traders

Trading can look daunting at first and it most certainly takes a long time to get used to. When first approaching the trading scene, or when looking to change up things a bit, thorough research is required to find a broker capable of meeting your trading needs while providing you with more opportunities to not only build but develop your trading strategy. Additionally, when you take automated trading as an already well-established approach in the industry that continues to grow with each year, the initial hurdle becomes even more palpable.

As a forex trader, there are two things that are important to you - finding the right broker and choosing the right trading strategy. The selection of a forex broker can make or break your progress as a trader. But with Eightcap, you know you’ve partnered with a quality company that provides excellent services to its clients.

Why Choose Eightcap?

While there are many brokers that offer a multitude of options and services, there are just a few that give you access to a range of financial tools and tight spreads, without sacrificing quality on its security to preserve your funds in place and provide you with a transparent trading environment. Eightcap is a brand that has proved its worth and has received global recognition for its MetaTrader 4 infrastructure, winning the award for Best MT4 Forex Broker Global in 2020.

“But, who is Eightcap?” you may ask. Eightcap is an Australian-based trading broker with a focus on providing its users with the ultimate secure trading experience on the MetaTrader 4 and MetaTrader 5 trading platforms. It delivers, what we may call an ultra-efficient technology infrastructure. This means that the pillar around which the company’s activity is centered is that of developing tools and services that tend to users’ needs at all times, so they can feel at ease when going long or short on the markets.

Having launched in 2009 in Melbourne, Australia, Eightcap has followed this vision of simplicity and mindfulness towards its clients by listening to them and staying true to what matters most – exceptional financial services. As a result, it now has several offices around the world and is regulated in different locations.

Eightcap is regulated in two jurisdictions and is considered globally trusted. Eightcap Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) (AFSL no. 391441). Eightcap Global Ltd is regulated by the Vanuatu Financial Services Commission (VFSC) (Financial Dealers Licence no. 40377).

Aside from that, there is also the naming, which, as you may presume, does hold special meaning – Eightcap’s fundamental principles are embedded in its name so that both its representatives and clients can always remind themselves what the moving forces behind everything are – security, relentlessness, personalisation, balance, intuitiveness and speed.

Getting Started with Eightcap

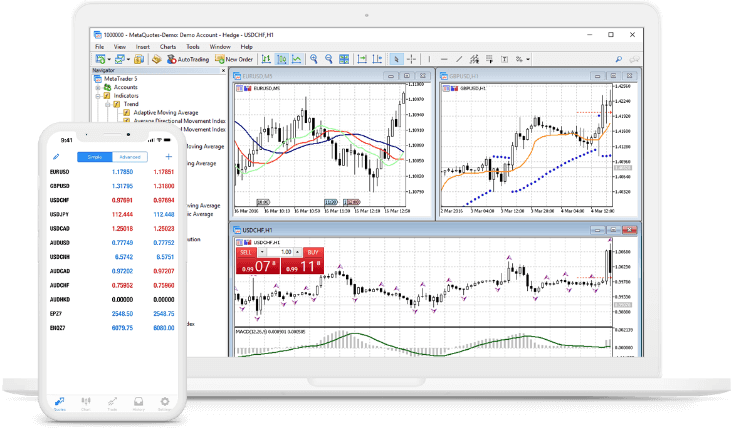

Going into the specifics of what you get if you decide to go with Eightcap and how it would work, we first have to explain the platform that you would use to execute your trades. The MetaTrader 4 trading platform has been around for more than a decade and has proven to be the most popular choice for most traders on a global scale. Its capabilities feature a slick interface that does not cheap out on the data shown, automation with a robot that will place the trades when you set specific conditions, and a system of charts that display all the relevant pieces that form the puzzle that is your trading strategy.

Software interfaces often prioritise one component over another, and this can make it hard to keep track of everything that helps you decide when it’s time to buy or sell. This may be due to a lack of space or customisability. As a result, missing out on valuable trading opportunities is not an uncommon occurrence and may even cause some traders to consider switching brokers. MetaTrader 4 does not suffer from a lack of options, so you have the chance to pull the strings at the right moment and in an efficient manner, with full visibility of what matters to you.

If you enjoy trading from both desktop and mobile, then the MT4 platform can make that happen; it works easily with Windows, Android, and iOS, without having to look for any alternative applications for your specific device and operating system.

In addition, there are chart timeframes that can provide you with a breakdown of the changes to the trading market in hours, minutes, or even seconds. On MetaTrader 4, there are 9 chart timeframes. They go along with technical indicators that further double down on the analysis of trends and volatility – you gain access to 30 of those with the MT4.

As you may already be aware, Eightcap is not the only finance broker who offers the MetaTrader 4 trading platform. However, it is one of the few brokers who offer access to the newer version, MetaTrader 5, that made its way onto the markets scene just several years ago. What differentiates the two is nothing more than technical capabilities and accessibility options, with the MT4 being the more popular choice because of its familiarity.

Those just starting out would perhaps find more comfort in infrastructure that’s even richer in content than the MT4. That’s because the MT5 platform opens up the possibility to trade not only from desktop and mobile, but from web browsers as well; you can take your trades literally everywhere – all you need is an online connection.

MT5 also expands on the chart timeframes and technical indicators numbers from 9 and 30 to 21 and 38 respectively. For the extra timeframes that you get, this means you can focus on looking for more trading opportunities by gaining an exhaustive view over all the different periods during which a market, and a specific part of it, has seen a change. As mentioned earlier, thorough research is necessary for finding the right broker, but it doesn’t end there. In fact, it’s only the beginning, as you have to be on top of the latest trends to make informed choices when placing a trade.

Trade Automation: What You Should Know

A defining aspect of the MT4 and MT5 platforms is trade automation. This has seen extensive use by traders who want to trade without the fear of missing out (FOMO) on important moments to trade. You just have to set the parameters that would allow a free-of-charge trading robot to monitor the markets of your choice. Go long, go short, or go out - the robots will take over for you in the meantime.

Another important aspect is no doubt the actual markets that you get to trade on. The MetaTrader 4 and MetaTrader 5 platforms offer access to several such markets, and the most common one, forex, or foreign exchanges, is the first that comes to mind for most. Eightcap’s forex currency pairs are over 40, including both major and minor ones on both platforms.

The FX market, being the top liquid market in the world, generates a large portion of the trading population and the profit it makes. When you trade currency pairs, be that EUR/USD, USD/JPY, USD/CAD, USD/CHF, GBP/USD, AUD/USD, or any others for that matter, you do it over-the-counter (OTC), ]without central exchanges. Remember the aforementioned timeframes? They come into play here and you can follow the fluctuation of prices with ease by using those.

The same thing goes if you are looking to trade Commodities. The buying and selling of oils and precious metals have always been a hot topic; they are the ones affecting economies worldwide, alongside other natural resources. Conversely to forex, commodity prices take more time to establish trends that can last up to 5 or 10 years.

With Eightcap, you can trade WTI Oil Contracts for Difference (CFDs) and take long or short positions based on global events impacting the price. Similarly, you can go with Brent Oil, which is becoming the global benchmark for the energy market. Precious metals have held their value throughout history and if your preference is to trade gold or silver, Eightcap can help you do that. But make sure to take factors that affect their price, such as recent price history, into consideration.

Let’s not forget about stock trading on Index CFDs – these can be bought and sold through the MT4 and MT5 platforms with Eightcap’s 24-hour trading window and servers located in Equinix data centers for high and steady speeds to take positions with no delay. You can speculate the movement of assets, using the trading instruments at your disposal, and hold a position until you believe the time is right. Such index assets include: US30, FRA40, GER30, UK100, AUS200, EUSTX50, JPN225, SPX500, NDX100m and HK50. When trading CFDs, you will be making speculations that can take you in either direction of loss or profit.

Share CFDs, or stock CFDs, are the additional market you can trade on when you pick the MetaTrader 5 trading platform – both US and Australia’s 250 largest stocks fall on your radar. These include Apple, Tesla, Netflix, BHP Group, and Woolworths, among others.

Trading CFDs on individual shares can allow you to invest in positive and negative price movements, and you don’t even have to buy the underlying share. CFDs also enable you to use leverage and increase your exposure, which means that you can enjoy even more flexibility in opening or closing positions.

What Else?

So far so good, but maybe there is something else that doesn’t make this as appealing – it’s as straightforward as it looks. Eightcap’s spreads start from a zero, so you can also start strong. If you aren’t familiar with spreads, this is the gap between the bid and ask, or buy and sell price of any financial asset. It’s what defines forex and CFD trading to a great extent – the tighter the spread, the better the value. Eightcap and other brokers rely on spreads to earn revenue from trades. You can think of it as commission fees and brokerage charges.

Just as the volatility of a market is affected by ongoing events throughout the world, so are spreads. Brokers can decide to withhold information in order to make their offers look and sound juicier, which is a basic marketing strategy used everywhere, which oftentimes can lead to incorrect or unclear information being delivered to a client’s ear. Knowing that, Eightcap has decided to make transparency one of its strengths. Its pricing model is as transparent as can get, so you can see the difference, represented in pips, clearly. Take note that the spreads on Eightcap’s MT4 and MT5 platforms vary, and they come from top-tier liquidity resources as well as leading banks and other financial institutions.

Have you heard of Swaps or Rollovers? Indeed, those are not always carefully considered when going out for a broker chase. A Swap or Rollover rate is the interest that is charged or paid over a night of holding positions open in forex trading. As forex trading is basically currency pair trading, this interest rate is calculated by taking the difference between the two currencies in each pair, be that a long or short position. Eightcap plays no role in this process of trade, but it does have its own swap rates that can be viewed through one of the panels on the MetaTrader 4 and 5 platforms.

We already mentioned automated trading, but we did not point out that fully automating your trades does not come cheap. The good news is, Eightcap doesn’t charge you for it. They have partnered with a service called Capitalise.ai, which removes the coding portion of the automation and backtesting, and replaces it with keywords. You can input these keywords and set the instructions that a trading bot will follow and execute when monitoring the movement in the markets. Using Capitalise.ai, you can focus on building, developing, and adjusting your trading strategies, maybe even living a life while you are at it, and let trades execute themselves on all fronts.

And if you’re looking to make passive income to boot, you can consider the partnership program by the name of Eightcap Partners. Whether you want to be an Influencer, Affiliate, or Introducing Broker, you can make use of the competitive rebate, or cashback, by simply referring people who become active clients. The right program is one where conversion rates are low, and you can drive enough traffic to make a considerable profit from a monthly referral base. Eightcap’s Partners Program is very competitive and can be a rewarding way of participating in the global financial markets. The final and most important factor that can make everything else come crashing down is what a company’s clients and partners think of its services and how much they trust it with their funds and information. In Eightcap’s case, the numbers talk for themselves – the average score on Trustpilot is 4.6/5 and Google Reviews are at an average of 4.7/5*. Now that you are aware of what Eightcap is, what it offers, how it operates, and how it is recognised, it is your turn to make the choice.

If you wish to open an account or give the demo version a try, Eightcap has you covered. You can start trading right now by going for a Raw or Standard account. Spreads start from 0 pips (Raw account) and the minimum deposit is $100, with the minimum trade size being 0.01 of a standard contract. Keep in mind that margin trading involves a high level of risk and is not suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before applying to Eightcap.

Eightcap Trading Account Types

1:500 Vanuatu (VFSC)

1:500 Vanuatu (VFSC)

Eightcap Sponsorships

Use virtual money on a Demo account. Evaluate all the possibilities, gain confidence and when you are ready, register a live trading account.

Funding / Withdrawal

Eightcap offers a wide range of funding options that are fee-free for traders in most countries. It's simple to manage your account with. Every client has an access to own secure client area, where he can access all funding and withdrawal needs safely and securely.

в CNY

в CNY

Eightcap Trading Platforms

MetaTrader 4

MetaTrader 5

Frequently asked Questions

Eightcap offers two types of accounts: Standard and Raw.

They have the same trading conditions and features. Though Raw account has tighter spreads and commission for every trade.

It depends on the payment option you used for depositing.

If you use a debit/credit card, funds are usually available in a trading account within seconds after completing the transaction.

If you fund via bank transfer, it can take from 1 to 3 business days, depending on your location and the bank.

Eightcap swap rates are calculated in the trading platform. Swap rates may be calculated using the following formula:

Current long/short rate * number of lots = swap debit/credit in second currency

General information

1:500 for Vanuatu (VFSC)

Skype

Skype

LiveChat

LiveChat

E-mail

E-mail

Facebook

Facebook

Telegram

Telegram

Viber

Viber

WhatsApp

WhatsApp