Tickmill Rebates

One of the ways that traders can save money when using Tickmill is through the use of rebates, which are cashback rewards given to clients for their trading activity.

To make the process of earning Tickmill rebates even easier, traders can use the services of Globe Gain. Globe Gain is a leading forex rebate provider that offers its clients access to exclusive rebates and discounts from a wide range of brokers, including Tickmill.

By using Globe Gain to access Tickmill rebates, traders can earn cashback rewards on their trades without any additional fees or charges. Globe Gain offers fast and reliable rebate payouts, and their customer support team is available 24/5 to assist traders with any questions or issues they may have.

To get started earning Tickmill rebates with Globe Gain, traders simply need to sign up for a free account with Globe Gain, link their Tickmill trading account, and start trading. As they trade, they will earn rebates on their trading activity, which will be credited to their Globe Gain account weekly basis.

Overall, using Globe Gain to access Tickmill rebates is a smart way for traders to save money and increase their profits. With competitive rebate rates, fast payouts, and excellent customer service, Globe Gain is the ideal partner for traders looking to get the most out of their trading experience with Tickmill.

If the trading account that you want to assign to our partner group was opened earlier, you need to send a request to the broker. A sample letter is shown on the right. The transfer of an account to a partner group occurs at the sole decision of the broker.

After a new trading account is opened, you can transfer money from your old account to a new one also in a few clicks in your Tickmill client's area.

Once your trading account has been transferred to our partner group, please send us an email notification support@globegain.com. This is necessary to speed up the approval of the invoice in our system.

Dear Sirs,

Please place my account xxxxxxxxxxx under IB55628504 or IBU24014940 (for Tickmill UK accounts).

Kind regards,

John Brown

Tickmill Broker review

Tickmill: A Reliable Forex Broker with Competitive Trading Conditions. Tickmill is a trusted forex broker that provides traders with competitive trading conditions, advanced trading platforms, and a wide range of trading instruments. Founded in 2014, Tickmill has rapidly gained a reputation as a reliable and transparent broker, offering a range of services to traders from around the world.

Trading with Tickmill provides traders with access to a range of trading instruments, including forex, commodities, indices, and shares, through the popular trading platforms MetaTrader 4 and MetaTrader 5. Traders can also benefit from a range of trading tools and educational resources, including market analysis, economic calendars, and educational webinars.

At Tickmill, traders can benefit from low spreads, fast execution, and deep liquidity. The broker offers some of the lowest spreads in the industry, starting from 0.0 pips, with no hidden commissions or fees. With Tickmill, traders can also benefit from leverage of up to 1:500, allowing them to increase their exposure to the market while limiting their risk.

Tickmill is also committed to providing its clients with a safe and secure trading environment. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Seychelles Financial Services Authority (FSA) in Seychelles. Clients' funds are also held in segregated accounts, ensuring that they are kept separate from the broker's own funds.

In addition, Tickmill provides its clients with a range of account types to suit their individual trading needs, including a Pro account for experienced traders and an Islamic account for traders who require a swap-free trading environment.

Overall, Tickmill is a reliable forex broker with competitive trading conditions and a commitment to transparency and security. Whether you are a beginner or an experienced trader, Tickmill provides the tools and resources you need to succeed in the markets.Tickmill Broker account types

Tickmill offers traders a variety of account types to suit different trading needs and preferences. The broker offers three main account types: the Classic account, the Pro account, and the VIP account.

The Classic account is designed for traders who are just starting out in the markets. It requires a minimum deposit of $100 and offers competitive spreads starting from 1.6 pips. Traders can access a wide range of trading instruments, including forex, commodities, and stock indices. The Classic account also offers a range of trading tools and resources, including free educational materials and market analysis.

The Pro account is designed for experienced traders who require tighter spreads and faster execution speeds. It requires a minimum deposit of $100 and offers spreads starting from 0.0 pips. Traders can access a range of advanced trading tools and resources, including free VPS hosting, Autochartist, and a range of expert advisors.

The VIP account is designed for high-volume traders who require premium trading conditions and personalized support. It requires a minimum deposit of $50,000 and offers spreads starting from 0.0 pips. Traders can access a range of exclusive benefits, including a dedicated account manager, priority customer support, and bespoke trading conditions.

In addition to the main account types, Tickmill also offers an Islamic account for traders who follow Sharia law. The Islamic account operates on a swap-free basis, with no rollover charges on overnight positions. It also offers competitive spreads and access to a wide range of trading instruments.

Overall, Tickmill offers a range of account types to suit the needs of traders from all backgrounds and experience levels. The broker's commitment to providing competitive spreads, fast execution speeds, and a range of advanced trading tools and resources makes it a popular choice among traders from around the world.

Tickmill Swap-free Account

Sure, I'd be happy to provide you with some information about Tickmill's Swap-free Account.

Tickmill is a global brokerage firm that offers a range of financial instruments and trading services to clients around the world. One of the account types that Tickmill offers is the Swap-free Account, which is designed to cater to the needs of traders who follow the Islamic faith.

According to Islamic law, it is forbidden to pay or receive interest on financial transactions. This means that conventional trading accounts, which typically charge or pay interest on positions that are held overnight, are not suitable for Islamic traders. The Swap-free Account offered by Tickmill allows traders to avoid paying or receiving any interest on positions that are held overnight, making it a Sharia-compliant option for Islamic traders.

In addition to being a Swap-free Account, Tickmill's Islamic account also offers other features that are designed to meet the needs of Islamic traders. These features include:- No commission charges - Islamic accounts do not incur commission charges on trades, which can help to reduce trading costs for clients.

- No hidden fees - Tickmill's Islamic account does not charge any hidden fees, ensuring transparency and fairness in all transactions.

- Wide range of trading instruments - Islamic account holders have access to a wide range of financial instruments, including forex, commodities, and indices.

- Expert support - Islamic account holders can rely on Tickmill's expert support team for assistance with any questions or issues that may arise.

Overall, Tickmill's Swap-free Account is a great option for Islamic traders who are looking for a Sharia-compliant way to trade financial markets. With its range of features and support, it is a reliable and trustworthy choice for traders around the world.

Awards and Recognitions

Tickmill has received numerous awards and recognitions for its services in the financial industry. Some of the awards and recognitions received by Tickmill include:

Best Forex Trading Conditions

Best Trading Conditions

Best Forex Broker Asia

International Business Magazine Awards 2020

Global Forex Awards 2019

Account verification

Tickmill requires all clients to complete an account verification process before they can start trading. The verification process is a mandatory requirement for all regulated brokers to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Here are the steps involved in verifying your account with Tickmill:

- Submit your personal information: During the registration process, you'll need to provide your personal information, including your name, address, date of birth, and contact details.

- Provide identification documents: Tickmill requires you to submit identification documents, such as a passport, national ID card, or driver's license. The document must be valid, and the information provided must match the details you provided during registration.

- Submit proof of address: Tickmill requires clients to submit a document that proves their address, such as a recent utility bill or bank statement. The document must be less than 3 months old and show your name and address.

- Wait for verification: Once you have submitted your documents, Tickmill's compliance team will review and verify them. The process usually takes 1-2 business days, after which you'll receive confirmation of your account verification status.

It's important to note that Tickmill takes the security of its clients' personal and financial information seriously and uses advanced security protocols to protect against fraud and unauthorized access.

Tickmill Demo accounts

Tickmill broker offers to its clients to open a demo account to make practice and to try different Tickmill account types and various trading strategies without any risks before trading “for real”. With a demo account a trader has a possibility to try more than 80 CFD trading instruments and to apply them in real Forex market conditions. Opening a Tickmill demo account is free and has no expiration dates.

Tickmill Deposit & Withdrawal Options

Tickmill offers a variety of convenient deposit and withdrawal options for traders, allowing them to easily fund and manage their accounts. The company strives to provide fast and secure transaction processing, with most deposits being credited to accounts within one business day. Traders can fund their accounts using a variety of methods, including bank wire transfer, credit/debit cards, and electronic payment systems such as Skrill, Neteller etc. Tickmill also offers the option of depositing in multiple currencies, including USD, EUR, GBP, CHF, PLN, and JPY. When it comes to withdrawals, Tickmill aims to make the process as smooth and hassle-free as possible. Withdrawals are processed quickly and efficiently, with most requests being completed within one business day. Traders can withdraw funds using the same methods that they used to deposit, and there are no fees charged for withdrawals.

в CNY

в CNY

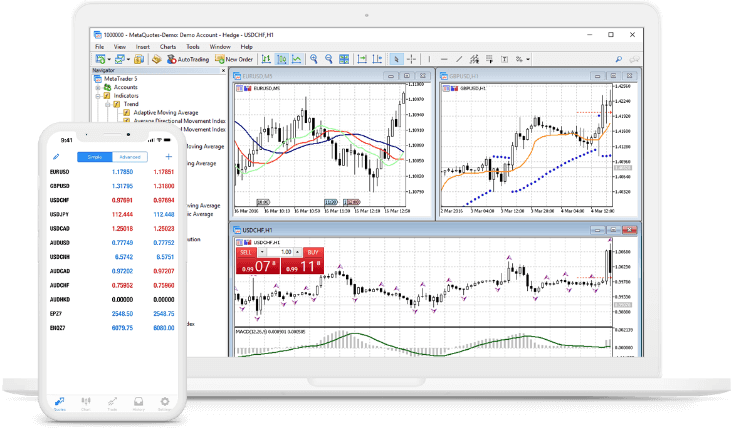

Tickmill Trading Platforms

Tickmill is a multi-asset online broker that offers trading services for Forex, Indices, Commodities, Bonds, and Cryptocurrencies. The broker provides its clients with access to three trading platforms, each designed to meet the needs of different traders: MetaTrader 4, MetaTrader 5 and WebTrader. All three platforms offered by Tickmill provide clients with access to a wide range of trading tools, including real-time market data, advanced charting, and trading signals. The broker also offers a range of educational resources, including webinars, trading guides, and video tutorials, to help traders improve their skills and make informed trading decisions.

In summary, Tickmill offers a choice of three trading platforms, each designed to meet the needs of different traders. Whether you prefer the advanced functionality of MT5, the user-friendly interface of MT4, or the flexibility of WebTrader, Tickmill provides a range of tools and resources to help traders succeed in the financial markets.

MetaTrader 4

WebTrader

Frequently asked Questions

General information

Tickmill is a regulated online broker that operates under the oversight of multiple financial regulatory authorities. The regulatory bodies that oversee Tickmill's operations depend on the region in which the broker operates, and they include:

Financial Conduct Authority (FCA): Tickmill UK Ltd, a subsidiary of Tickmill Group, is regulated by the FCA in the United Kingdom.

Cyprus Securities and Exchange Commission (CySEC): Tickmill Europe Ltd, another subsidiary of Tickmill Group, is regulated by CySEC in Cyprus.

Financial Services Authority (FSA): Tickmill Asia Ltd, a subsidiary of Tickmill Group, is regulated by the FSA in the Seychelles.

The above regulatory authorities are known for their strict regulations and oversight, and they ensure that brokers operate in a transparent and fair manner, with adequate measures in place to protect clients' funds. As a regulated broker, Tickmill is required to adhere to the rules and regulations set out by these regulatory bodies, which helps to promote trust and confidence in the broker's services.

Tickmill has some regional restrictions in place, and the broker may not be available to traders in certain countries due to regulatory restrictions. As of March 2023, Tickmill does not accept clients from the following countries: United States, Canada, Japan, Australia, New Zealand, Belgium, North Korea, Iran, Iraq, Syria.

Additionally, Tickmill may have some limited services available in certain countries, and traders are advised to check with the broker's customer support for the latest information regarding any restrictions or limitations in their region. It's important to note that the list of restricted countries may change, and traders are advised to regularly check the broker's website for updates.