Admiral Markets UK (FCA) Cashback Rates

revenue share

revenue share

MTT is the minimum duration of an open trade for cashback accrual.

Admiral Markets Australia (ASIC) Cashback Rates

revenue share

revenue share

MTT is the minimum duration of an open trade for cashback accrual.

If the trading account that you want to assign to our partner group was opened earlier, you need to send a request to the broker. A sample letter is shown on the right. The transfer of an account to a partner group occurs at the sole decision of Admiral Markets.

Once your trading account has been transferred to our partner group, please send us an email notification support@globegain.com. This is necessary to speed up the approval of the invoice in our system.

Dear Sirs,

Please place my account xxxxxxxxxxx under IB 35080.

Kind regards,

John Brown

Admiral Markets Review

Since 2001 Admiral Markets brokers has been in the online trading market. In 20 years, this broker has earned the reputation of one of the leaders in Forex and CFD’s trading, offering its clients excellent service and innovative solutions. At this point Admiral Markets is represented in 130 countries all over the world.

The broker provides access to highly functional software to guarantee its clients the best and transparent trading experience. The traders have over 8000 trading and investing instruments, including CFD’s on currency pairs, indices, stocks, cryptocurrencies, metals, and many others.

Admiral Markets broker is always improving the quality of its service, adding new options, like one-click trading or MetaTrader Supreme Edition, that is an exceptional upgrade of MetaTrader 4 and MetaTrader5 trading platforms.

The broker is regulated by several regulators: FCA in the UK, CySEC in Cyprus , AFSL in Australia, Estonian Investment and Brokerage Supervision Commission (EFSA).

On the eve of their 20th anniversary, Admiral Markets will be rebranding to Admirals, continuing to provide the excellent services.

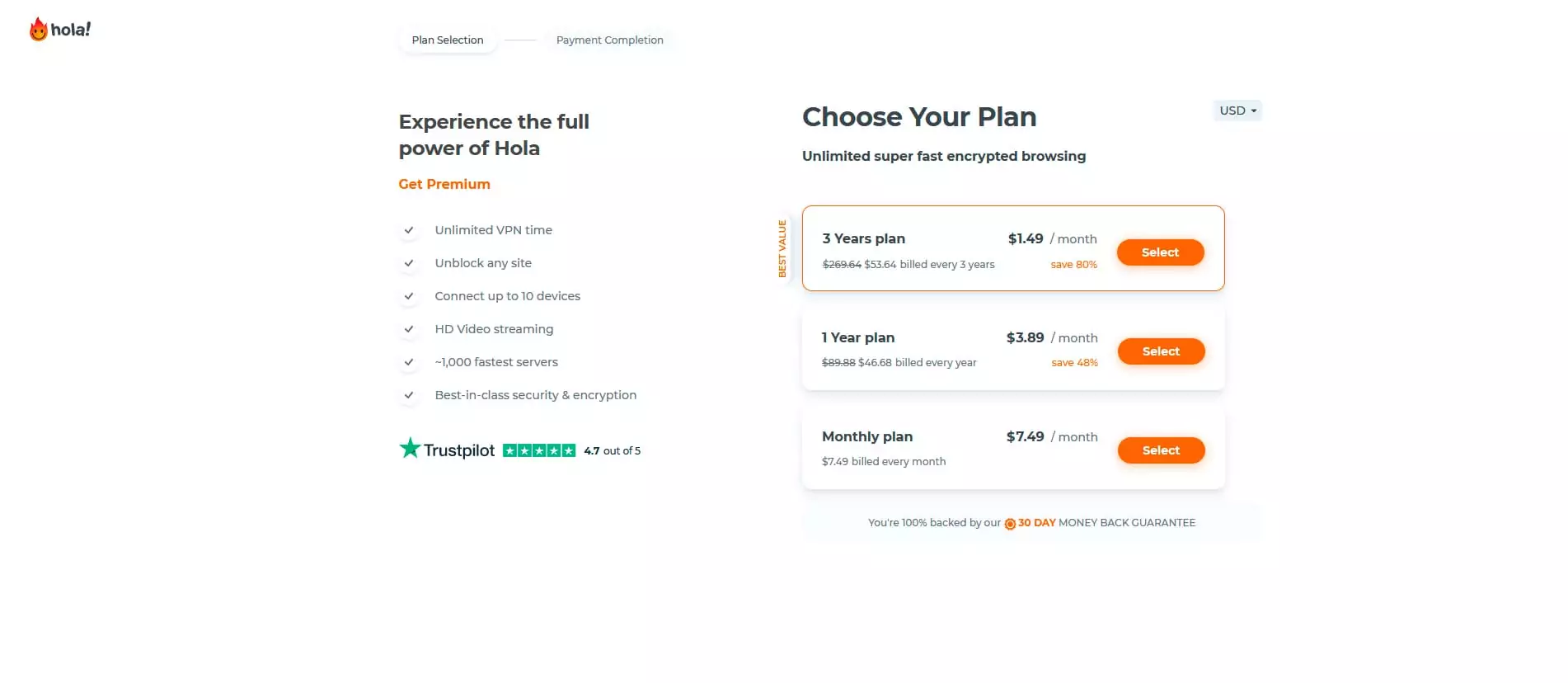

Admiral Markets Account Types

Admiral Markets Broker offers to its clients a wide range of account types, that are divided according to a trading platform: either MetaTrader4, or MetaTrader5. The account types are Trade.MT4, Zero.MT4 and Trade.MT5, Invest.MT5, Zero.MT5 respectively. The Admiral markets minimum deposit is $1 for Invest.MT5, the other accounts have a minimum deposit of $100. The broker also offers a possibility to the clients, that correspond to the specific requests, to upgrade their account to professional status.

or equivalent

or equivalent

or equivalent

1:500 for AU entity

1:500 for AU entity

1:500 for AU entity

Other instruments - no commissions

Cash Indices - from 0.05 to 3.0 USD per 1 lot

Trade.MT5

Admiral Markets swap-free account

Exness swap-free account is an Islamic Account for Muslim faith traders. This type of Exness account corresponds Sharia law and has a fixed fee instead of swap. The traders from Islamic countries get a swap-free option automatically during an account registration, the traders from non-Muslim countries can also have a swap-free option and should choose between 2 different levels of swap-free trading accounts: Standard Swap-Free or Extended Swap-Free. Both these levels can be applied to any of the live trading accounts offered and they are determined by the trader’s trading activity.

Admiral Markets Demo account

With Admiral Markets Broker a trader can open a demo trading account, free from risks, because you use virtual money. This type of account can be useful for novice traders, as it lets them try forex trading and have live market experience, as well as for expert traders, who can test new strategies. A demo account can be opened for 30 days, but if a trader opens a live account, a demo account won’t expire.

Deposit & Withdrawal Options

Admiral Markets Broker can offer several ways to deposit and withdraw. For deposit a client can choose between a bank transfer that can take up to 3 days and has no commission, Visa or Mastercard, Skrill, Neteller, Paypal, iBank,Klarna, iDeal, and Safety Pay. Almost all of them are instantaneous and have no commission, except Skrill and Neteller. For withdrawal are available: a bank transfer, Visa or Mastercard – for both methods it can take up to 3-5 business day, and Skrill – here the process is instantaneous. For Visa or Mastercard a trader doesn’t pay any commission, for other two methods a client has two free withdrawal requests per month.

business days

INR, MYR, ZAR, COP, AED

AUD, SGD, BRL

or equivalent

or equivalent

INR, MYR, ZAR, COP, AED

AUD, SGD, BRL, CNY, NGN

or equivalent

or equivalent

business days

INR, MYR, ZAR, COP, AED

AUD, SGD, BRL

or equivalent

or equivalent

INR, MYR, ZAR, COP, AED

AUD, SGD, BRL, CNY, NGN

or equivalent

or equivalent

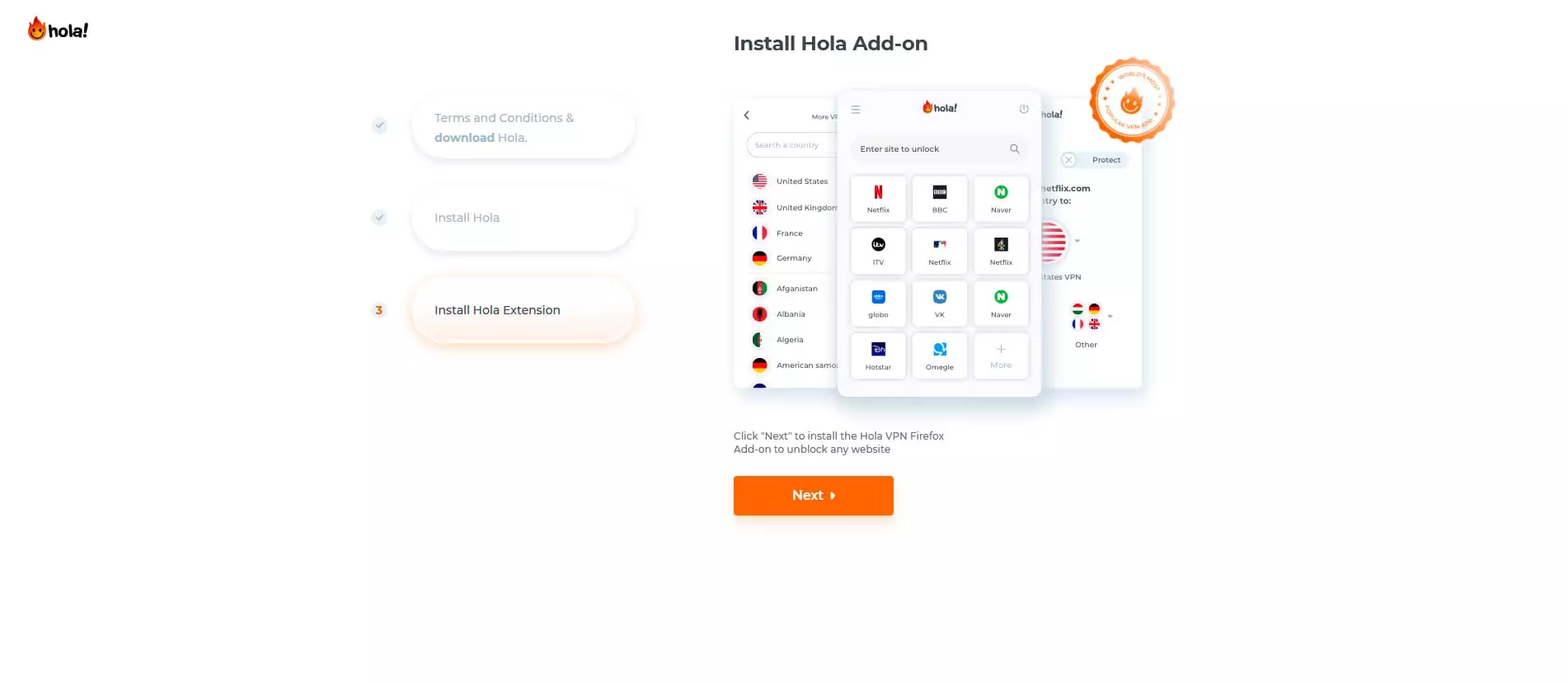

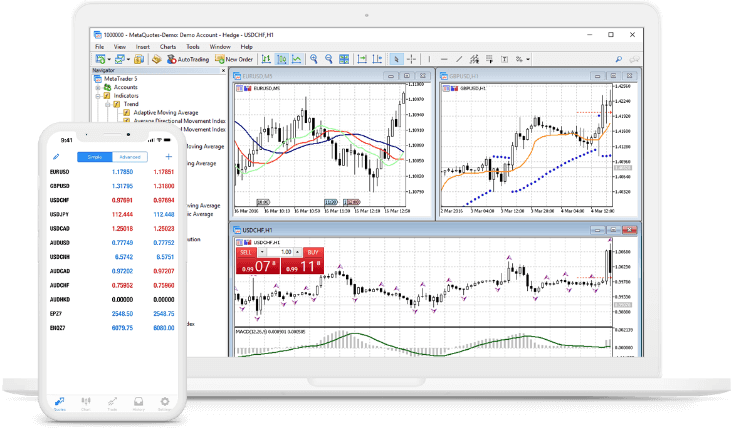

Admiral Markets Trading Platforms

MetaTrader 4

MetaTrader 5

WebTrader

Frequently asked Questions

General information

Financial Services Authority (FSA). Nymstar Limited is a Securities Dealer authorized and regulated by the Seychelles Financial Services Authority (FSA) with license number SD025. View Nymstar Limited's FSA License Details

Financial Sector Conduct Authority (FSCA). Vlerizo (Pty) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa as a Financial Service Provider (FSP) with FSP number 51024. View Vlerizo's FSCA Financial Service Provider License

Cyprus Securities and Exchange Commission (CySEC). Exness (Cy) Ltd is a Cyprus Investment Firm, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 178/12. View Exness (Cy) Ltd's CySEC Investment Firm License

Additional services

Among the additional services offered by Admiral Markets broker, the clients can see Forex calculator, a special trading tool, that allows checking possible profit or loss, as well as calculating margin or getting details about pip value.

Custom service

Admiral Markets offers professional custom service, that is available in many languages, among them are English, French, Spanish, Russian, Dutch. Traders can contact an Admiral Markets client service via email. Live chart, phone and a web form.