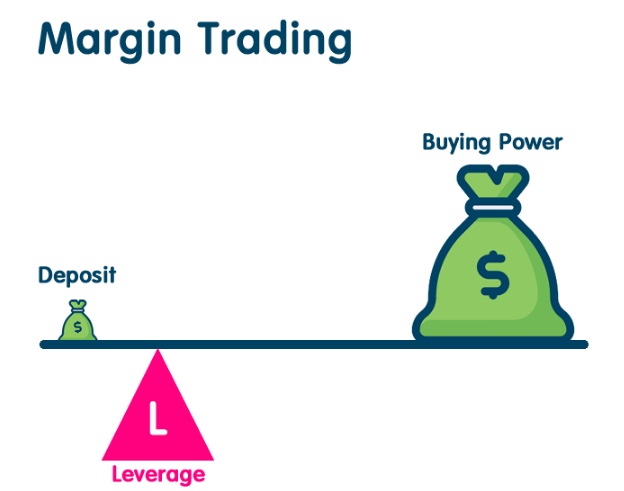

As we all know, there are many different investment targets in the world. It can be felt that risks are different when trading different symbols . Many people believe that margin trading (CFDs like foreign exchange pairs) is a high-risk variety. Is that true? This article categorizes the risks of common trading methods (including foreign exchange transactions), which would be helpful for amateur traders.

Level 1 – Trades that do not require a stop loss.

Generally speaking, we cannot trade without taking risks, and the probability of success of a transaction is often not 100%. In order to prevent losing all their money, more…