The common currency was trying to fix itself above 1.13 level several times during two previous weeks. Bulls managed to accelerate the pair highest possible up to 1.1360, but the key resistance at 1.14 remained unreachable. Extremely low volatility on the markets until Friday explained by hints expectations from the Fed about chances of soon rates rising. Yellen's speech about possible September rising could not convince markets. However, Fisher, Fed VP, has commented that the words of his Chief they should consider as a hint for the possibility of the rate rising in September. This revelation brought to the markets a storm of emotions – dollar started to grow. On Monday, EURUSD remained below 1.12, although the pair increased up to 1.1340 straight after Yellen's comments. The global image of the EURUSD pair looks like return downwards followed by another unsuccessful attempt to climb above 1.14, the level the pair cannot overcome during last 20 months. The worst scenario for the pair looks like movement towards 1.05 (the lower boundary of the channel) and the further falling to the area 0.83 – 0.87. Though, the chances are higher that the pair will face serious issues to move below 1.05, turning again upwards. The third option – repeating of tendency from 1999-2000. EURUSD then dropped below 0.83 twice, and the third impulse was enough only for the bounce to 0.86, and then has followed the multiannual uptrend. Divergence of the monetary policy and the real difference in the economy condition decline so far such scenario, but, as we witnessed more than once before, arguments of economists and market actions may have no connections with each other.

Last week the sterling was attempting to break resistance of the downward trend, until Yellen's and Fisher's speeches returned the pair to the traded levels. The decline continues on the week opening, and the pair again occupies level at 1.31 – somewhere between 1.28 and 1.35, the trading area after brexit referendum.

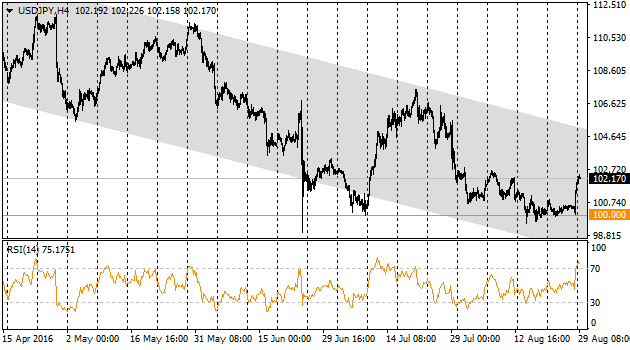

The pair is trying to fix itself above 102, leaving the dangerous closeness to psychological mark of 100 yen per dollar. The pair's grow can be partially explained by dollar strengthening on Friday. With the same extent, USDJPY growth based on words of Kuroda that he is undoubtedly ready for further easing if needed. By the way, in a short-term, the pair may be threatened by the rebound for compensation of the overbought situation on 4H charts.

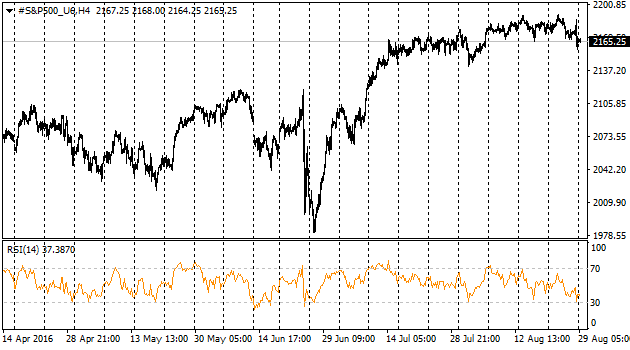

US Broad market index dropped on Friday in the middle of trades due to the speech of Fed Chairman. Regardless of the fact that the index had overcome significant part of its loss by the end of trades (since they presented optimistic outlook to the economy in Fed), it has more chances for further market decline, at least as a correction. «Reloading» is suggesting itself on the background of stocks overbought situation (based on P/E and other measures), along with the evident underestimation of chances for sooner rate rising by federal reserve.