EUR/usd

The pressure on the dollar failed to last for all day long yesterday. eurusd was reversed near 1.2800 and pushed off to 1.2665 during the New-York session. This decline made up for almost all losses suffered on the release of fomc's minutes. Now the pair is close to the support level of the short-term trend. If in the coming hours bears become more active and manage to push the pair below yesterday's lows, the dollar will be strong enough to resume its rally and continue growing in accordance with the fundamental indicators. However, should the upward movement continue, we will probably witness the development of the correction activity in the near future. It is quite unlikely that it will be caused by some publication of macroeconomic statistics: today we have only a report on the export/import prices in the USA, which doesn't have much impact on the markets. It is much more interesting to watch the opposition of hawks and doves in the Fed and the ECB. Members of the former yesterday expressed their concerns that the market makes too much fuss about dates instead of connecting it with economic statistics. And the Fed Vice Chairman, Stanley Fisher, blurred this timeframe, noting that ‘ a considerable time', pointed out in FOMC's comments, refers to ‘between two months and a year'. It means that when Janet yellen earlier this year said that it made about half a year, she took an average figure from a very large interval. In its turn, the ECB faces a growing opposition of Germany against draghi's policy. It shows itself in the increasing displeasure of the country's political parties. Of course, the Fed is formally an independent bank, but it still can yield to the pressure of the German society, purchasing assets less intensely and fast than promised initially.

GBP/USD

Unlike the euro, the British pound expects important news today. The trade balance statistics don't promise any dramatic changes, but still can prove to be slightly better as far as deficit is concerned due to decrease in the commodity and energy prices in the recent months. In the meantime, we believe that the preceding appreciation of the British currency and also its strength against the euro won't help to improve the long-standing issue of Britain – a serious trade deficit.

USD/JPY

The pair has tumbled down below 107.80, but doesn't hurry to go lower. The absence of drivers for growth or decline enables the pair to drift between the levels of the previous two consolidations, which can hardly be called a steady situation. We'd rather expect a short-term decrease to 107.40

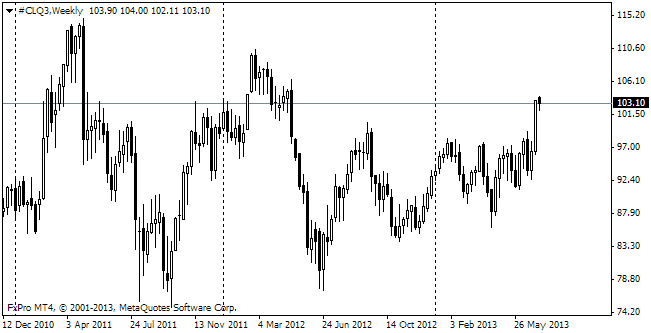

Oil

Oil has lost over 20% off its recent high, which means a change for the bearish market. Often in such situations the instrument keeps falling for a while as investors actively reduce their investments into this instrument. Besides, Oil is affected by such factors as production growth in the USA and closeness of access to oil-production capacities of Iran for Europe. Thus, this instrument still has some potential for decline.