EUR/usd

Yesterday the US markets went through a one-minute drop by over 2% on the news that the House of Representatives wouldn't vote for adopting a new fiscal policy. Republican leader Boehner, the speaker of the House, announced that since the bill didn't have enough advocates, the vote would be postponed. Boehner's “plan B” hasn't worked. Now both the parties have to quickly come to a mutual agreement, otherwise the automatic spending cut and tax increase will deal a hard blow to the economy. The Forex market took the news calmer. The euro tried to get to 1.33 yesterday afternoon, but in the evening was pushed back by a figure. This morning the euro went as low as 1.3180, which is a bit lower than yesterday's intraday low. Skeptics may regard this as a feeble attempt to break the resistance and so will wait for the further depreciation of the currency. But we've characterized this as a profit squeeze. It's just going on in a choppy pre-holiday market. Our recommendation to those who want to take a strategic position – stay out of the market and wait for a good opportunity to step in. Quite likely, the high volatility of these days will drive the pair to one of the extremums. It's now clear that the rest of speculators are going to purchase the dollar on bad news regarding the fiscal cliff and sell it on good news concerning the negotiations. It has nothing in common with what we saw in summer 2011.

GBP/USD

The attempts to stir up the market were observed in the sterling as well. The pound/dollar once again tried to go up to 1.63 and once again was pulled back by the bears. Now trading is at 1.6250. At these levels the bulls still have some chances to step in the game. Turning to the news, yesterday's retail sales release is of interest. As expected, no pleasant surprises here – instead of the forecasted growth by 0.3%, the sales haven't shown any increase at all. And against November 2011 they have grown just by 0.9% instead of the expected 1.5%. Today's agenda contains the news on the Public Sector Net Borrowing.

USD/JPY

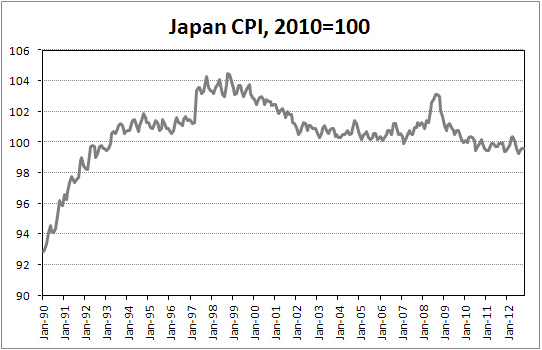

To our great surprise, yesterday the bulls still tried to take the pair away from 84.0. The general positive in the markets has coincided with the expectations that the target inflation in Japan will be raised by 2%. It is a very ambitious objective for the country, whose PPI is now lower than on March 1993. For comparison, in the US CPI has grown by 61% for the same period of time.

USD/CAD

Unlike Britain its former colony, Canada, surprised by its retail sales statistics yesterday. The sales volume grew by 0.7% in October. Anyway, this news won't keep the markets happy for long. Against the previous year the growth makes 1.7%. These data are not inflation-adjusted and if we adjust the figures for inflation, the increase will total less than 1%. Today we look forward to inflation statistics for November. On average it is expected that inflation shrank by 0.1% in November and slowed down to 1.0% annually. Yet, yesterday's statistics gives us hope that the actual data will surpass the expectations and support the Loonie as a result.