EUR/usd

The comments, preceding yesterday's speech of yellen, often contained hints at the possible beginning of an uptrend in USD. Actually, Yellen's speech was of the same mood as the previous comments, that is rather dovish and cautious. Anyway, market participants got what they wanted – the dollar started its ascent. Addressing the Congress yesterday, Yellen drew attention to the persisting high rate of unemployment and the need for the stimulating monetary policy. In our opinion, these words clearly unveil the fear to allow sharp and quick toughening of the monetary policy and repeat the mistake, made by the Fed in the 30s. It is quite possible that market participants are again too optimistic in their expectations just like in 2010 and 2011. As you remember, at that time they expected rate increases already in 6-9 months, but then got disappointed and in a few more months the economy was in dire need for new incentives. Anyway, digressing from reasoning, we get the following. The US retail sales fell much short of the expectations, growing by 0.2% instead of 0.6%. Yellen refused to turn from a dove into a hawk, bringing into focus weakness of the economy as well as of the labour market. Besides, eurusd dropped from 1.3617 to 1.3568 during the day and is now trading at 1.3550. From the fundamental point of view, the euro's weakness can be accounted for only by the belated reaction to ZEW's poor estimate of the Economic Sentiment in Germany and Europe. The index fell to the lowest level since the end of 2012, which is much below the expectations. The same index for the whole eurozone tumbled from 58.4 to 48.1 against the expected growth to 62.3. Where do these optimistic expectations come from?!

GBP/USD

The British pound had a nice rally yesterday. The consumer activity acceleration from 1.5% y/y to 1.9% brought many fans to the sterling. That alone was enough to cause a rally by over 130 pips, hit fresh local highs and reach the highest levels since October 2008, i.e. 1.7190. Partially the sterling's rally became a heavy burden for the euro. Traders were selling EURGBP and hitting of weekly lows provoked further decline. Now the main threat for the British currency is posed by the possible unwillingness of the BOE to hurry with policy toughening and also by weakness of the industrial production and consumer demand.

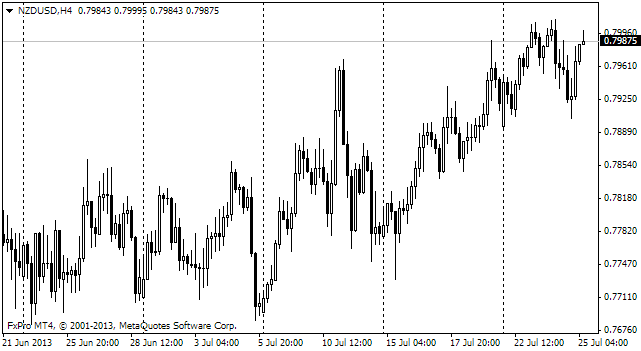

NZD/USD

The New Zealand dollar surprisingly missed a double attack. Firstly, traders with long positions locked in their profits on Yellen's speech. And then all of a sudden the consumer inflation in 2Q proved to be poor. The prices increased by 0.3% instead of the expected 0.4%. The annual inflation made 1.6% instead of speeding up to 1.8% as expected. The stakes that the RBNZ would prefer a pause before toughening the policy grew immensely.

USD/CAD

Today the Bank of Canada publishes its interest rate decision and makes a report on the monetary policy. No one expects that the rate will change, but traders are sure to pay careful attention to the tone of the comments. The previous inflation data supported the Canadian Loonie and last week's employment data stirred serious concerns about strength of the recovery. Adding here deterioration of the foreign trade prospects caused by the growing gas production in the USA, we get little hope for rate increases in the foreseeable future.