The American Fed Reserve managed to cause weakening of its own currency. On Wednesday dollar turned downwards that reflected in EURUSD rise to 1.1250 area on Monday. The same levels are highs of the previous two weeks. Moreover, the current levels are close again to the resistance line of the downtrend, which turned the pair in August and September. Hence, the current marks represent important resistance area. Now it will not be easy for the dollar to turn back to growth, since the key event – Fed Reserve meeting – has shown not that firm attitude of committee members as expected before. Maybe, only US payrolls have enough potential for dollar's trend return. However, they will be released in two weeks only. If EURUSD is not able to stay below 1.1250, the further battle may take place only near 1.1400 area. Already during one and a half year, the pair cannot take this level and keep it for some continuous time. The economic data from Europe do not influence significantly the pair's quotes. Only ECB news may cause effective movement for euro. And now, two weeks beforehand we have received unexpectedly quite unusual shift from the ECB. The bank pointed out, more transparently than earlier, that the next step should be from the side of fiscal policy and not the monetary one. The bank itself did not look ready to widen stimulus actively. On the contrary, Fed Reserve does not look ready to increase rates. Therefore, they need quite strong data from the USA to break the trend of dollar weakening, and it is better to have hawkish comments of fomc officials. Most probably, in such conditions USD will slowly step back in EUR USD pair to the area of the important resistance at 1.1400 level.

The British pound was moving downwards having small stops meanwhile; the downtrend started three weeks ago. Currently the pair is dangerously close to the support level after brexit around 1.2850. The pressure for the pound caused again by the talks about Britain exit from the EU, but not the weak economic data. As a whole, macroeconomic statistics of the country is better than expected.

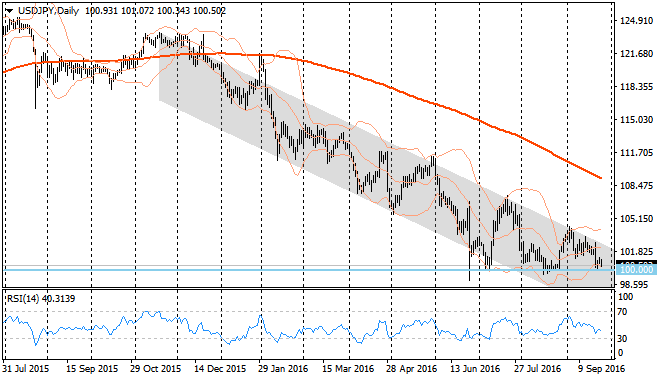

Last week the pair could not break the downtrend, getting away from its resistance. On the other hand, the pair has its support on the physiologically important level of 100 yen for a dollar. As a result, the trading range continues its tightening. Eventually, the consolidation should end up with volatility boom. The technical analysis is showing continuation of decline. Fundamental analysis (actions of the US and Japanese Central Banks) is talking that the pair growth has more chances.

The pair was constantly rising during last 8 trading sessions and, probably, it is close to the reverse point of the trend. All this time NZD and AUD were moving in different directions against USD, which caused the powerful movement of the pair AUDNZD. In a short-term, the pair looks vulnerable for the correction. The impulse decline will be confirmed by dropping below 1.05.