EUR/usd

The disappointing rates of the Japanese growth would keep putting pressure on the global stock indices but for draghi's speech yesterday which brought some relief to the market. The ECB's governor again pointed at the readiness to provide more incentives, including bond purchases in case inflation goes below the forecast inflation. These comments boosted demand for stocks of the EU periphery and for stocks around the world as well. Tapering in the US didn't put an end to the epoch of easy money. Now it is coming from Japan and the eurozone. Moreover, members both of the European and Asian CBs speak about an opportunity to build it up. Against this background, it will hardly be reasonable for long-term investors to stake on strengthening of the euro against the dollar. But at the same time, in the short term USD is extremely overbought, so further growth is likely to be preceded by a significant pullback. Last week's upsurge in the pair ruined the picture of the convergent triangle, which would serve as a herald of further decline. But since it didn't happen, the current situation looks like formation of an upward support, lasting for a week and a half. Last night the pair found support at 1.2440 and now enjoys moderate demand, gradually climbing off the weekly lows. This growth may target an upper bound of the short-term uptrend with the levels exceeding 1.2560. Breaking above them can send the pair much higher on an avalanche of triggering stop orders from the disappointed in the steady growth of the dollar. But in the meantime the picture of the euro's pullback can be ruined by Germany's business sentiment data. Today's ZEW index is expected to be back in the positive area, which probably won't happen as Europe is still concerned about the situation in Ukraine and its role in it and also about the uncertainty for business and financial flows in this connection. Apart from the ZEW index, the markets can be affected by statistics on the US producer prices. It is expected that they fell by 0.1% in October and their annual inflation has slowed down to 1.2% in the general index and to 1.5% in the core index. This report may be crucial for consumer inflation, which will be released in two days.

GBP/USD

The British pound, which just like the euro was trying to find support yesterday, is vulnerable today before the release of statistics. The market expects a whole row of inflation data, which will give information on producer prices, consumer inflation and also on performance of the real estate industry. GBP-bulls need strong stats, which will help to forget the cautiousness of the BOE's officials last week, when the inflation report spoke about slower price growth, postponing the date of the forecast rate increase in Britain.

USD/JPY

Market observers are more and more sure that Prime Minister Abe will put off the sales tax increase to stimulate the economy. Advocates of this scenario emphasize the need to give the country's economy a chance to get stronger before tightening the screw. The extremely early attempts to ‘normalize' the budget deficit and the interest rate are considered to be the main reason of the lost decade. Well, we actually can speak already about two decades of the lost growth.

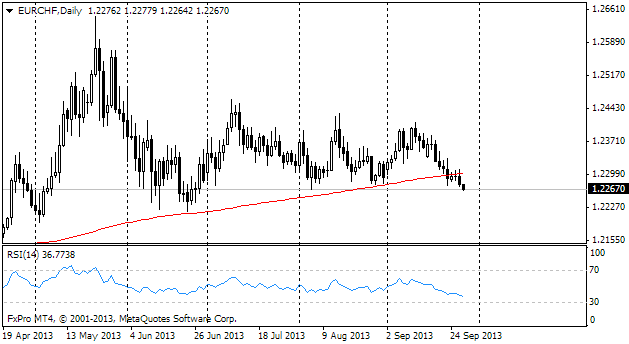

EUR/CHF

For the preceding two weeks the pair has been climbing down. And the nearer it drew to 1.20 the more cautious it became. The low was hit just 9 pips away from this line, which was then followed by signs of stabilization. Probably, here it will be reasonable to buy if you are sure that the SNB won't let the market below this line.