EUR/usd

The EU inflation keeps slowing down. The most important news here came yesterday from Germany, which didn't see any price growth in November after the decline by 0.3% a month before. Yet, the annual inflation rate dropped to 0.6%. Last time inflation was that low at the end of 2009 because of the economic meltdown and cut in consumer spending. Now the situation is a bit different. The unemployment level is the lowest since the time of Germany's reunification, as was shown in the employment report for November. Besides, it was messaged that the number of the unemployed had decreased again – by 14k after falling by 23k in October. Such a low inflation is caused by the anemic demand growth and decrease in energy prices. Besides, it should be taken into account that decline of earnings in the southern countries extends the range of goods, whose prices can be adjusted down. Southern Europe is energetically fighting for their outlets. There's nothing else for it to do but cut their spending, prices and salaries. For example, yesterday's data on Spanish inflation pointed out the development of deflation. Over the year prices fell down by 0.4%. Probably, the recent decline of the euro will help to stabilize the situation in the coming months, but we can't fully rely on this due to the continuing growth of energy prices. Thus, the need in the extension of the ECB's incentives is getting higher and higher. The Bank is heading in this direction and will possibly get down to it in the first quarter. On the one hand, these hints stopped speculations that it may happen in December. But on the other hand, it cuts the risks that this policy easing won't take place at all. So it follows that in the near future the single currency will remain under pressure, which can get weaker when the US stats fall short of expectations. For bears the level of 1.2350 will be important, breaking through which it will be free to go to 1.20.

GBP/USD

The uptrend, which was forming more than a week, hasn't withstood the attack of bears. The support line has been broken without much resistance from bulls today. It looks that they were given a chance to have little fun above 1.5800, but then were blown off by bears to 1.5680. Breaking through the support of 1.5670 – the preceding contact with the lower bound of the uptrend – will confirm the development of a new continuous phase of decline.

USD/JPY

Demand for the US dollar made traders again consider purchasing of usdjpy. Trading is again held above 118.20. And again the target level of 120 seems to be quite reachable in the coming month. They say that the markets love round levels at the end of the year. 120 is one of such levels. Further we can suppose that the Japanese officials can again speak that strong fluctuations of the currency won't do any good to the economy.

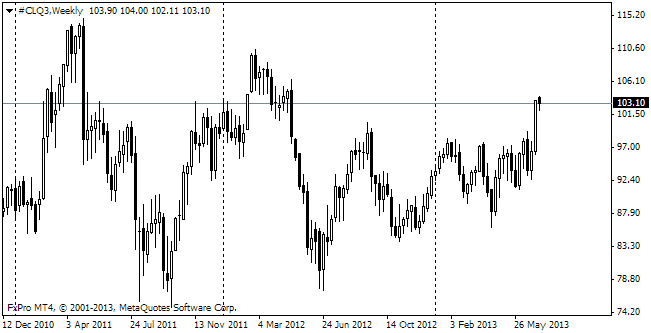

oil

The cartel didn't work. The participants promised to observe the established quotes of 30bln barrels a day. But it is rumoured in the market that these quotes were exceeded. It is supposed that under the current conditions the participants will be obliged to strictly observe the prescribed rules to win back the market's trust in the significance of quotes. And then should the decline continue, they will have to decrease the quotes to maintain prices. WTI Oil is now trading below $70/barrel, close to the lowest level of 2010 – 67.15. The lowest rate of 2009 is 33.56…