The previous week became quite productive for the pair. On Wednesday, after fomc comments, the American dollar got under pressure. Despite of the fact that the committee mentioned improvements in the economy and risks decline in the nearest perspective, the comment did not include anything about rate increase next time, as it was done last October before they raised the rate in December. They just made a standard comment about readiness to make it on any of the next meetings. But definitely this is not the sign for the tightening in the nearest future. Either the members of federal reserve have not started yet to form their expectations pointing out the raise on the next meetings. This case we will have ahead in the most optimistic scenario for the dollar (pessimistic for EURUSD). On Friday dollar felt worse. First GDP estimation of 2Q increased by 1.2% (annual rate or 0.3% quarter on quarter) against expected 2.6%. Such significant difference with expectations created additional pressure to dollar, thus it was declining on all markets.

Therefore, EURUSD has added 220 points, moving to the same direction almost the whole week. This as well helped the pair to recover after decline during one and a half week and to close the month in a small plus of 70 points. Macroeconomics of the Eurozone was demonstrating, on the contrary, quite good results. GDP estimation for Q2 has shown growth by 0.3% q/q and it is close to the USA growth rate, but they expect less from the Eurozone. Annual growth rate beaten the expectations with 1.6% y/y. The inflation continued its acceleration, having reached 0.2% y/y against expected and previous level of 0.1%. This week they will focus on employment market. The markets will be searching the answer for the question – what is the tendency: strong data of the previous month or extremely low May data ? ADP statistics and weekly unemployment claims will cause the higher interest and can cause higher volatility. The biggest volatility occurs usually due to payrolls in the beginning of September but statistics released by the end of this week may either create the start of the powerful movement, showing a new idea for the “big money” who came back from holidays.

The British pound as well managed to move closer to usd, but this increase was in the range of decline the week before which did not allow sterling to break relatively tight trading channel. Actually, the markets simply switched over to the waiting mode – waiting for measures and comments from the Bank of England. They will be released this Thursday along with inflation estimation and economic forecasts. Cable is quite attractive for the middle term buying, being above 1.30. But short term traders, keeping cautiousness, should not risk and should wait better for the Bank of England decision.

The Bank of Japan disappointed everyone on Friday by scope of its stimulus – they widen ETF buying and dollar crediting, but did not raise the level of cash flow build up and did not decrease the rate. Accompanied by the bad news from the USA and the further pressure to USD, the pair USDJPY is starting a new August week around 102.30 level – having regained 70% of rally on stimulus expectations from the Bank of Japan and Abe government. Though, we are used to disappointments from the side of authorities of the country of the rising sun.

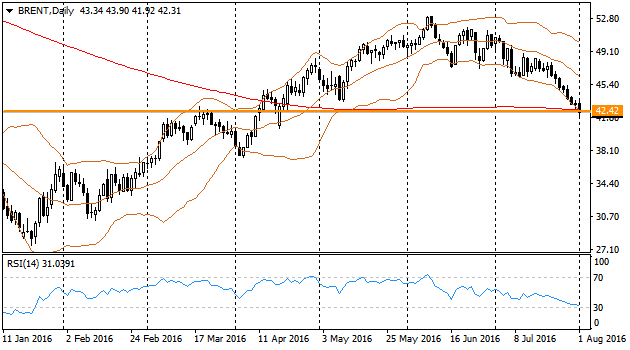

Oil continued to move down, getting into bearish market phase on some contracts on Monday, August,1. This means oil most probably will lose another 15-20% during coming month and much more – in several months. There are solid reasons for this: opec is increasing production, the same is happening in the USA, meanwhile the consumption is growing in less volumes. In case the chances for renewal of lows from the beginning of the year are low the downtrend movement will be formed and will stay with us for a quite long time.